Tips for buying your first new car can feel like trying to learn a new language while riding a rollercoaster. It is exciting, right? That new car smell, the pristine paint, the promise of adventure. But then the anxiety creeps in. The confusing financing terms. The fear of negotiating. The nightmare of being taken advantage of by a smooth-talking salesperson.

Take a deep breath. You are not alone.

This guide is here to change that. We are going to transform that anxiety into absolute confidence. This is not just another list; this is your personal roadmap. Consider this your trusted friend, giving you the inside scoop on how to navigate this journey like a pro. So, let us buckle up and dive into these seven brilliant tips for buying your first new car.

Tip 1: Get Your Financial Ducks in a Row (Before You Even Look at a Car)

This is the most non-negotiable, crucial step for any first-time car buyer. Falling in love with a car before you know what you can afford is a recipe for financial stress. You must be the boss of your budget before the dealership has any say.

- Know Your Credit Score: Your credit score is your financial report card, and it directly determines the interest rate on your loan. You can check your score for free through services like Credit Karma or your bank. A higher score means a lower rate, which can save you thousands of dollars over the life of the loan.

- Set a Rock Solid Budget: A great rule of thumb is the 20/4/10 rule. This is a time-tested guideline to keep you from overextending yourself.

- 20:Aim for a 20% down payment. This lowers your loan amount and shows the lender you are a serious buyer.

- 4: Finance the car for no longer than 4 years (48 months). Longer terms mean lower monthly payments, but you pay significantly more in interest and risk being “upside down” (owing more than the car is worth) for longer.

- 10: Your total monthly auto expenses (loan payment, insurance, fuel) should not exceed 10% of your gross monthly income.

- Get Pre-Approved: This is your secret superpower. Go to your bank or a local credit union and get pre-approved for a loan. This tells you exactly how much you can spend and gives you the power of a “cash buyer.” You can walk into the dealership knowing you already have financing secured.

Tip 2: Become a Research Ninja (Knowledge is Your Best Weapon)

In the age of the internet, there is no excuse for walking into a dealership unprepared. A significant part of any new car-buying guide is dedicated to research. This is where you level the playing field.

- Needs vs. Wants: Be brutally honest with yourself. Do you need a sunroof and heated seats, or do you need great gas mileage and five-star safety ratings? Make a list of your must-haves versus your nice-to-haves.

- Compare Models and Trims: Use websites like Edmunds, Kelley Blue Book (KBB), and Consumer Reports to compare different models in your class. Pay close attention to reliability ratings, owner reviews, and standard features for different trim levels. Often, the base model has everything you actually need.

- Pinpoint the True Price: Do not focus on the Manufacturer’s Suggested Retail Price (MSRP). This is the sticker price. The number you want to find is the Invoice Price. This is what the dealer pays the manufacturer. Knowing this gives you a realistic target for negotiation. These prices are readily available on the same research websites.

Tip 3: Your Secret Weapon: Secure Your Own Financing

When learning how to buy a new car, many people assume the dealership is the only place to get a loan. This is a common mistake. While dealer financing can be convenient, it is not always your best bet.

- Why Go External? Your bank or credit union often has relationships with you and may offer more competitive interest rates, especially if you have a good banking history.

- Use it as Leverage: Walk into the dealership with your pre-approval letter in hand. You can still be polite and let the dealer’s finance manager try to beat your rate. This creates competition, which works entirely in your favor. You are no longer a captive buyer; you are a savvy shopper with options.

Tip 4: Master the Art of the Test Drive (This is Not a Joyride)

The test drive is your chance to interview the car. It is not just about seeing if it drives straight. You need to be meticulous.

- Drive Your Real World: Do not just take the dealer’s preset route around the block. Insist on driving on roads you normally use. Get it on the highway to check for wind noise and acceleration. Drive on a rough road to test the suspension.

- Play with Everything: Adjust every seat, mirror, and steering wheel. Connect your phone to the infotainment system. Does it make sense? Is it easy to use while driving? Make sure you have enough headroom and legroom.

- Listen and Feel: Turn off the radio. Listen for any strange rattles, squeaks, or engine noises. Does the transmission shift smoothly? Do the brakes feel firm and responsive? This is your only chance to find these things out before you sign on the dotted line.

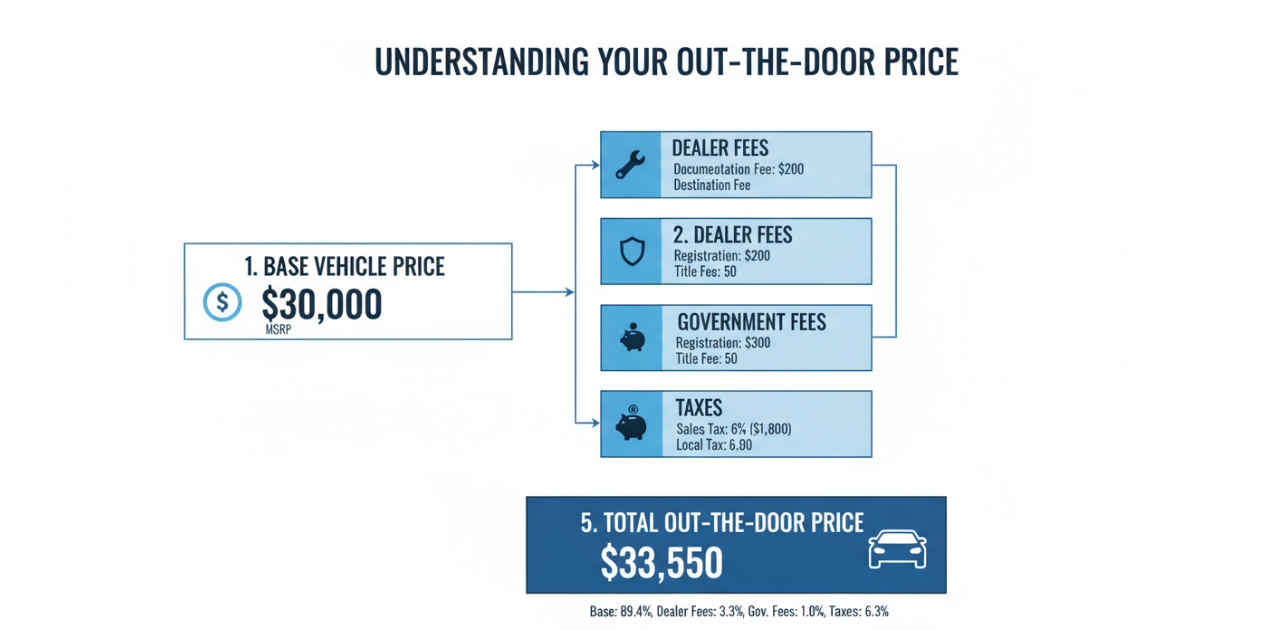

Tip 5: Look beyond the Sticker Price (The “Out the Door” Number is King)

This is one of the most critical car-buying tips. The price on the window is a fantasy. The only number that matters is the “Out the Door” price.

- What is the “Out the Door” Price? This is the total, all-inclusive price you will pay to drive the car home. It includes:

- The negotiated price of the car

- Sales tax

- Registration and title fees

- Documentation fee (often capped by state law)

- Beware of the Finance Office: After you negotiate the car price, you will meet with the F&I (Finance and Insurance) manager. This is where they will try to sell you extended warranties, fabric protection, paint sealant, and other products. Most of these are high-profit items for the dealer and are not necessary. Politely but firmly decline them. You can always add a manufacturer-backed warranty later if you feel you need it.

Tip 6: Negotiate with Confidence (You Are in Control)

Negotiation is the part everyone dreads, but it does not have to be a confrontation. Think of it as a collaboration where you are working toward a fair price.

- Start Low, But Be Realistic: Based on your research, you know the invoice price. Start your offer slightly below that. The dealer will likely counter, and you can meet somewhere between the invoice price and the MSRP.

- The Power of Silence: After you make your offer, be quiet. Let the salesperson respond. Silence is an incredibly powerful negotiating tool.

- Be Ready to Walk Away: This is your ultimate power. If the dealer will not meet a price you are comfortable with, you must be prepared to thank them for their time and leave. There are thousands of dealers and plenty of cars. This single action will get you a better deal more often than any other tactic.

Tip 7: Read the Fine Print (The Final Checkpoint)

You are tired, excited, and ready to drive away. Do not let this fatigue cause you to skip the most important final step: reading the paperwork.

- Read Every Single Line: Do not let them rush you. Ensure every number on the contract matches what you agreed upon, especially the “Out the Door” price.

- Verify There Are No Sneaky Fees: Check one last time for any additional fees that you did not approve.

- Understand Your Contract: You are signing a legally binding document. Make sure you understand the loan term, interest rate, monthly payment, and total cost of the loan. If something is wrong, speak up immediately.

Conclusion: You Are Ready to Drive Away a Winner!

Look at you! You’ve just navigated the seven key steps to becoming an empowered, informed, and confident first-time car buyer. These first-time car buyer tips were designed to guide you from uncertainty to clarity, giving you a solid foundation for buying your first new car. You’re no longer walking into a new car dealership hoping for the best; you’re walking in with a plan, a budget, and the knowledge to execute it. This is your complete car buying guide for beginners, equipping you with practical insight on how to buy a new car and get a fair deal on a ride that fits both your lifestyle and your wallet.

As you explore your options, you might also find it helpful to check out resources like the benefits of high-octane fuel (https://muzblogs.com/12-powerful-benefits-of-high-octane-fuel-in-cars/), discover some of the best car gadgets for 2025 (https://muzblogs.com/best-car-gadgets-2025/), compare the top cars for long road trips (https://muzblogs.com/the-12-ultimate-best-cars-for-long-road-trips-in-2025/), or review the best and worst cars of 2025 (https://muzblogs.com/best-and-worst-2025-cars-top-suvs-sedans-and-evs/). All of these can help you make an even more informed decision before you sign on the dotted line.

So go forth, use this ultimate guide, and enjoy the journey. The open road in your brand-new car is waiting for you.

FAQs

1. What is the first thing I should do before buying my first new car?

Start by checking your credit score and setting a realistic budget before visiting any dealership.

2. What is the 20/4/10 rule for car buying?

It means: 20% down payment, a loan term of no more than 4 years, and car expenses not exceeding 10% of your income.

3. Why is getting pre-approved for a car loan important?

It gives you a clear budget, helps you avoid bad financing offers, and strengthens your negotiation power.

4. Should I get financing through the dealership?

You can consider it, but compare it with your bank or credit union. Often, outside lenders offer better rates.

5. What should I research before buying a car?

Research models, trims, reliability ratings, safety features, fuel economy, and the invoice price.

6. What is the invoice price of a car?

The invoice price is what the dealer pays the manufacturer, and it’s the best starting point for negotiations.

7. How do I test drive a new car properly?

Drive on real-world roads you normally use, test highway performance, check visibility, comfort, and the infotainment system.

8. What does “Out the Door” price mean?

It is the final total price, including taxes, registration, documentation fees, and the negotiated price.

9. Should I buy extended warranties from the dealership?

Only if needed. Most add-ons offered by the finance office are optional and often overpriced.

10. How can I negotiate the best price on a new car?

Start below the invoice price, stay confident, use silence effectively, and be ready to walk away.

11. Is it normal to feel anxious about buying a new car?

Yes! It’s a big purchase. But research, planning, and pre-approval remove most of the stress.

12. What should I check before signing the final paperwork?

Verify the loan rate, monthly payment, terms, and fees, and ensure the “Out the Door” price matches your agreement.